Multi-leg Options Positions (Part 2 — Call Spreads and Put Spreads) | by Cryptarbitrage | Deribit Official | Medium

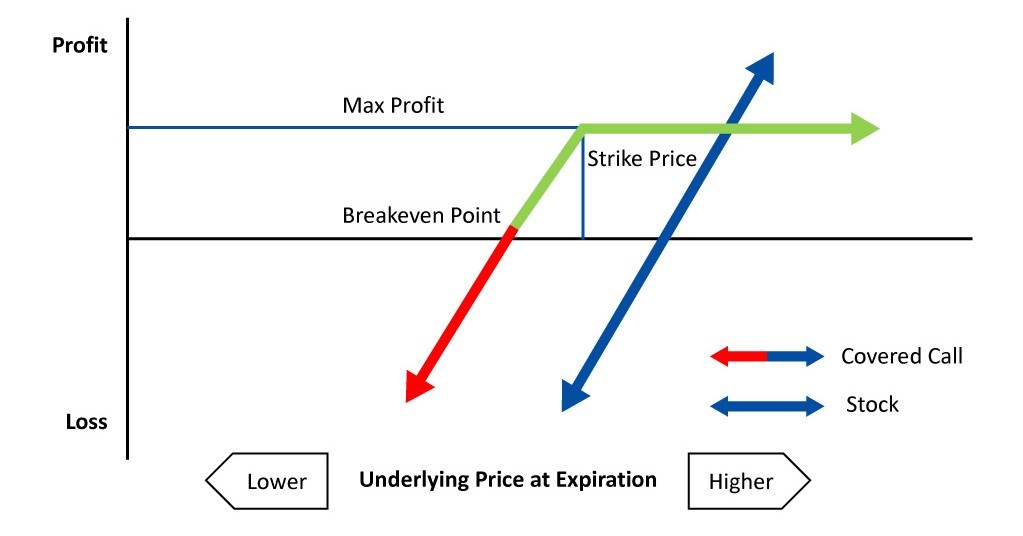

A trader buys a call option with a strike price of $40 and a put option with a strike price of $40. Both options have the same maturity. The call costs $3

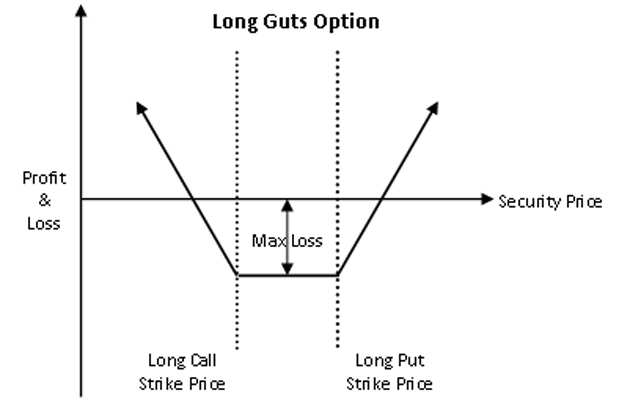

What is Guts Options (gut Spread)? Definition of Guts Options (gut Spread), Guts Options (gut Spread) Meaning - The Economic Times

stocks - Why doesn't someone choose the lowest Strike Price when choosing an CALL option? - Personal Finance & Money Stack Exchange

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_A_Newbies_Guide_to_Reading_an_Options_Chain_2020-01-92888ba78f8a4f519e037a483501af81.jpg)